– The AI company has enhanced its biometric verification service as businesses see more fake signups and account takeovers.

– The improved offering enables businesses to implement robust biometric-based authentication to combat organized fraud and synthetic identities.

– The new addition complements the wide array of global IDV and KYC checks ComplyCube offers, including AML Screening, Document Verification, Multi-Bureau Checks, and more.

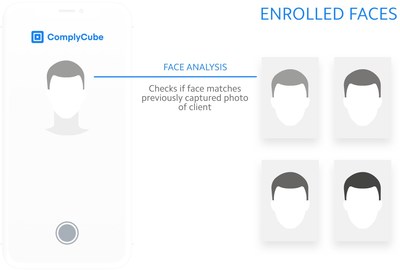

LONDON, June 21, 2022 /PRNewswire/ — ComplyCube, the all-in-one verification platform, has rolled out face authentication, further strengthening its biometric verification offering. The new service checks a client’s facial and biometric attributes against previously enrolled faces, empowering businesses to implement robust authentication mechanisms for gated services or account reactivations.

The new offering ensures that businesses are better equipped to protect themselves from organized fraud and synthetic identities.

Fake signups enable fraudsters to claim new account bonuses, cash drops, or simply to create mule accounts.

Criminals are increasingly bombarding businesses with fake signup requests by rotating a set of faces across hundreds of different attempts a day, using a variety of expertly crafted fake identity documents. Organized gangs typically choose this type of attack as they have the resources to launch large-scale operations. A higher volume of attempts means a higher chance of success.

Traditionally, to prevent this type of fraud, a business must manually review identity documents and keep a blacklist of faces connected to fraudulent documents. ComplyCube’s enrolled faces capability removes the need for a manual process by checking at scale for duplicate faces used at onboarding. So, a customer creating multiple accounts will be caught even if different personal information is used.

Synthetic identity fraud combines real information such as a stolen Social Security Number (SSN) with fake details such as a fictitious name to create a new identity. The synthetic details are then used to apply for credit online. Credit bureaus typically reject the application because the synthetic identity has no credit history. However, the application alone means the crafted identity has now a credit file. The synthetic details are then used to make more credit applications until one is accepted, usually by a high-risk institution. Synthetic fraudsters can build a credit record that eventually grants access to more valuable institutions.

This type of fraud is on the rise because stolen personal data is easier and cheaper to access than ever before. Nowadays, criminals on the dark web are selling SSNs, full names, driver’s license numbers, passport numbers, and email addresses for as little as $4. This means database checks, in which personal data is checked against independent sources alone, cannot be effective against fraud.

That’s why businesses choose ComplyCube’s comprehensive verification platform to layer biometric checks on top of document checks and database checks to have the best chance of keeping identity fraud at bay.

ComplyCube is a leading SaaS platform for automating Identity Verification (IDV), Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, with customers across telecoms, financial services, healthcare, e-commerce, crypto, and more.

SOURCE ComplyCube